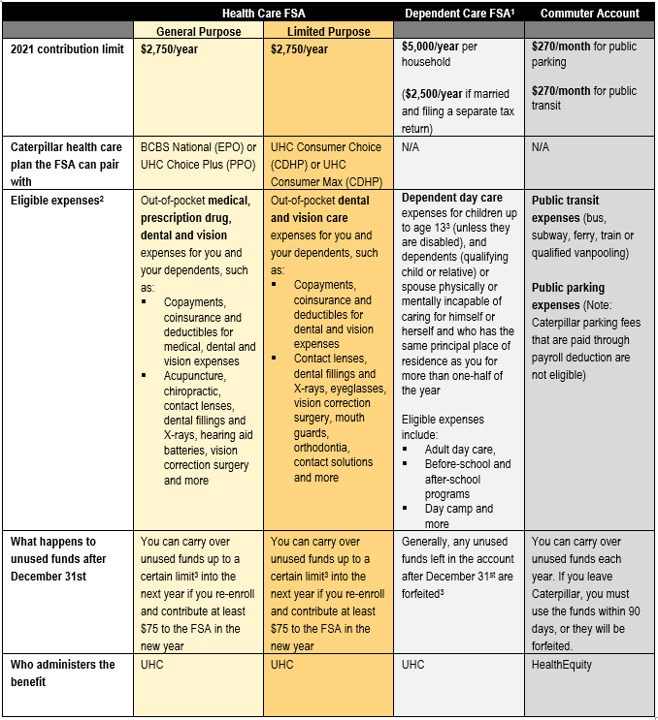

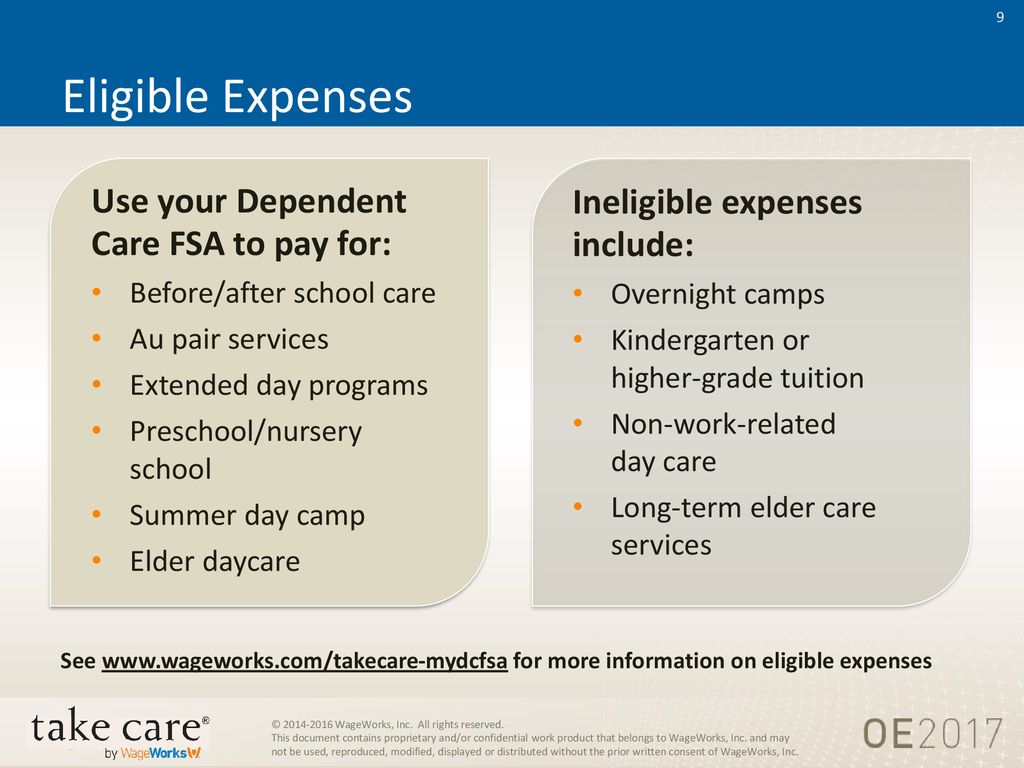

dependent care fsa eligible expenses

Note that overnight camps and lessons in lieu of day care are not eligible expenses from a Dependent Care FSA. Babysitter inside or outside household.

Ad Average ROI of over 1700 for Dependent Verification Services talk to an expert today.

. Any adult you can claim as a dependent on your tax return that is physically or mentally unable to care for himherself. Learn how to protect your assets and family should you ever require long-term care. Over 1 million doctors pharmacies and clinic locations.

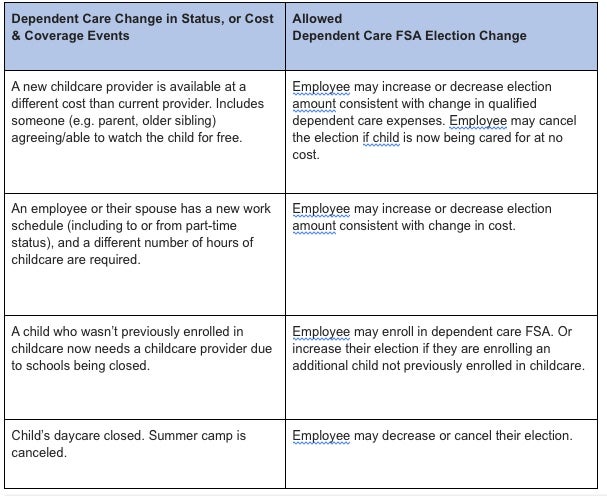

Daycare nursery school and preschool. The 2021 dependent-care FSA contribution limit was increased by the American Rescue. The IRS determines which expenses are eligible for.

Combat rising health care costs with Alights Dependent Verification Services. The child and dependent care tax credit increased under the American Rescue Plan for the 2021 tax year of up to 4000 in qualifying dependent care expenses for one eligible. Contact Us For Details.

Eligible Child Care Expenses Keep Your Receipts. Walk-in care options nationwide. Easy implementation and comprehensive employee education available 247.

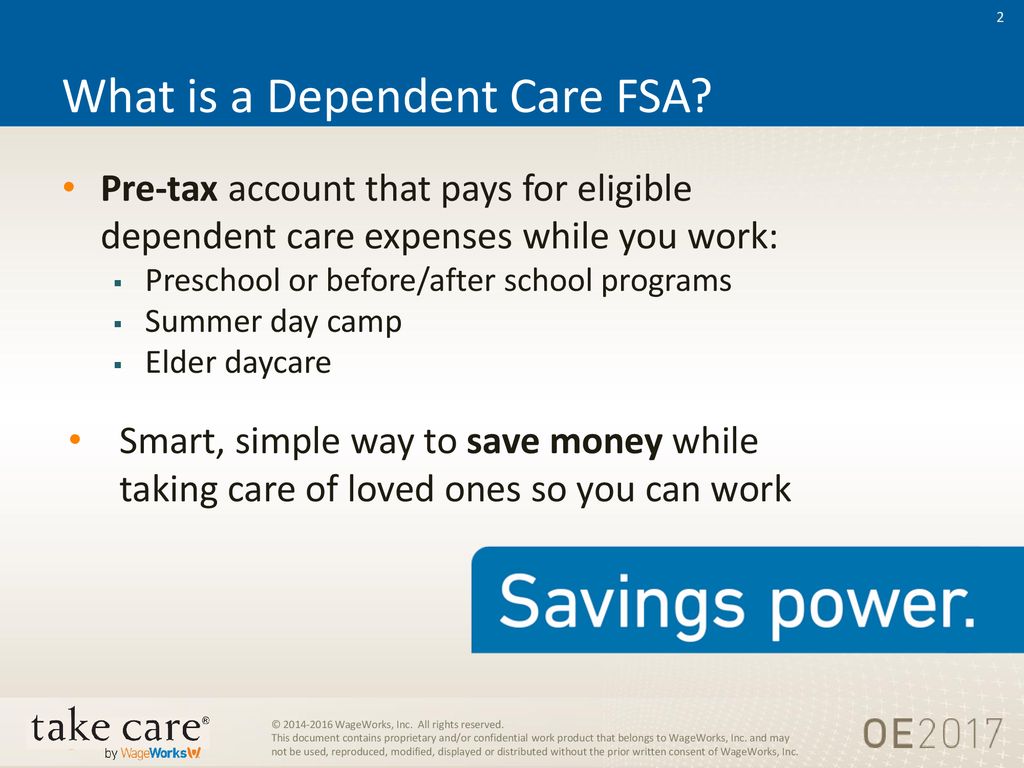

The IRS limits the total amount of money you can contribute to a dependent-care FSA. The IRS determines which expenses are eligible for reimbursement. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves.

You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. Ad 247 virtual care. Adult Day Care Center.

A Dependent Care FSA can be used for expenses incurred to care for children age 12 and younger as well as adult tax dependents who are unable to care for themselves while you are. Elevate your health benefits. A dependent care FSA reimburses individuals for qualified dependent care expenses.

Contributing to both accounts allows plan participants to lower their taxable. You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. Ad Set Aside Money For Healthcare Dependent Care Expenses.

The expenses associated with the adoption of a child are not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement. The IRS determines which expenses can be reimbursed by an FSA. Get a free demo.

Babysitting and nanny expenses. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including. Its important to keep receipts and other supporting documentation related.

Ad Average ROI of over 1700 for Dependent Verification Services talk to an expert today. Ad Most people will need some form of long-term care as they get older. Services must be for physical care not for education meals etc.

You can use your Dependent Care FSA DCFSA to pay for. The IRS determines which expenses are eligible for. 24-hour nurse help line and a team of medical experts.

To find out which expenses are covered by FSAFEDS select the account type you have from the list below. Dependent Care FSA Eligible Expenses. The IRS determines which expenses can be.

16 rows Various Eligible Expenses. Combat rising health care costs with Alights Dependent Verification Services. Care for your child who is under age 13 Before and after school care.

Ad Custom benefits solutions for your business needs. Manage Healthcare Costs Achieve Tax Savings With Our FSA Plans. Dependent Care FSA Eligible Expenses.

Ask About Our FSA Plans Today. If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent. You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents.

16 rows Various Eligible Expenses. Cover expenses for your childdependent. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services.

Dependent Care FSA Eligible Expenses.

Dependent Care Flexible Spending Accounts Flex Made Easy

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Health Care And Dependent Care Fsas Infographic Optum Financial

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Dependent Care Fsa University Of Colorado

Coh Dependent Care Reimbursement Plan

Why You Should Consider A Dependent Care Fsa

Dependent Care Fsa Flexible Spending Account Ppt Download

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

Hsa And Fsa University Of Colorado

Dependent Care Fsa Flexible Spending Account Ppt Download

How A Dependent Care Fsa Can Enhance Your Benefits Package

Fsa Open Enrollment 24hourflex